rhode island tax table 2020

Rhode Island Property Tax Rates. The supplemental withholding rate for 2020 continues at 599.

Rhode Island Department Of Human Services Facebook

This means that these brackets applied to all income earned in 2019 and the tax return that uses these tax rates was due in April 2020.

. State Tax Tables. INCOME TAX WITHHOLDING TABLES wwwtaxrigov. Of the on amount Over But Not Over Pay Excess over 0 66200 375 0 Use for all filing status types TAX If Taxable Income- Subtract d.

Check the 2022 Rhode Island state tax rate and the rules to calculate state income tax. Rhode Island Tax Brackets for Tax Year 2020. Rhode Island Taxable Income Rate.

Find your pretax deductions including 401K flexible account contributions. The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022. The Rhode Island income tax rate for tax year 2021 is progressive from a low of 375 to a high of 599.

Employees must require employees submit state Form RI W-4 if hired in 2020 or when making withholding tax changes in 2020. Pay Period 15 2020. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three children maximum 750.

There are -848 days left until Tax Day on April 16th 2020. Effective January 1 2020 employers must have employees complete Form RI W-4 show-. The income tax withholding for the State of Rhode Island includes the following changes.

Find your income exemptions. If your taxable income is larger than 100000 use the Rhode Island Tax Computation Worksheet located on page T-1. EXEMPTION FORMS FORM W-4.

How Income Taxes Are Calculated. To be used for Rhode Island income tax purposes will be the identification number currently issued to an employer by the United. Rhode Island Income Tax Rate 2022 - 2023.

Rhode Islands tax brackets are indexed for inflation and are updated yearly to reflect changes in cost of living. Single is the filing type used by all individual taxpayers who are not legally married and who have no dependants for whom they are monetarily responsible. 0 - 66200.

The table below shows the income tax rates in Rhode Island for all filing statuses. If you still need to file a return for a previous tax year find the Rhode Island tax forms below. Ad Download Or Email RI-1040NR More Fillable Forms Register and Subscribe Now.

Tax Bracket Tax Rate. Find your gross income. Fiscal Year 2021 - Tax Roll Year 2020 tax rate per thousand dollars of assessed value Click table headers to sort.

How to Calculate 2022 Rhode Island State Income Tax by Using State Income Tax Table. The income tax wage table has been updated. How to Calculate 2020 Rhode Island State Income Tax by Using State Income Tax Table.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. Forms RI-1040 and RI-1040NR have been updated for tax year 2020 to include a checkbox on page 1 to indicate if all members of y our tax household had minimum essential coverage for the full year. Check the 2020 Rhode Island state tax rate and the rules to calculate state income tax.

Rhode Island state income tax rate table for the 2022 - 2023 filing season has three income tax brackets with RI tax rates of 375 475 and 599 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses. Find your income exemptions. Ad Download Or Email RI-1040NR More Fillable Forms Register and Subscribe Now.

Find your gross income. The annualized wage threshold where the annual exemption amount is eliminated has increased from 227050 to 231500. The state income tax table can be found inside the Rhode Island 1040 instructions booklet.

Part-year residents filing Form RI-1040NR may check the checkbox on page 1 line 15b if all members of the. The Rhode Island Division of Taxation has released the state income tax withholding tables for tax year 2020. The Rhode Island 1040 instructions and the most commonly filed individual income tax forms are listed below on this page.

These numbers are subject to change if new Rhode Island tax tables are released. What is the Single Income Tax Filing Type. In order to be eligible for the Child Tax Rebate please remember to file your tax year 2021 Personal Income Tax Return by August 31 2022 or if you have.

In order to be eligible for the Child Tax Rebate please remember to file your tax year 2021 Personal Income Tax Return by August 31 2022 or if you have. Rhode Islands income tax brackets were last changed one year prior to 2020 for tax year 2019 and the tax rates were previously changed in 2009. The Rhode Island tax rate is unchanged from last year however the.

Less than 100000 use the Rhode Island Tax Table located on pages T-2 through T-7. No action on the part of the employee or the. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three children maximum 750.

Town Residential Real Estate Commercial Real Estate Personal Property Motor Vehicles. Find your pretax deductions including 401K flexible account contributions. Rhode Island Single Tax Brackets TY 2021 - 2022.

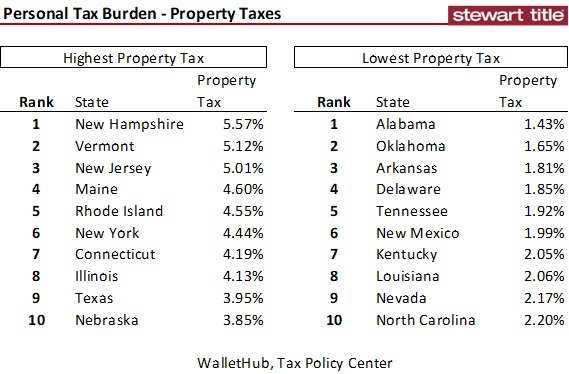

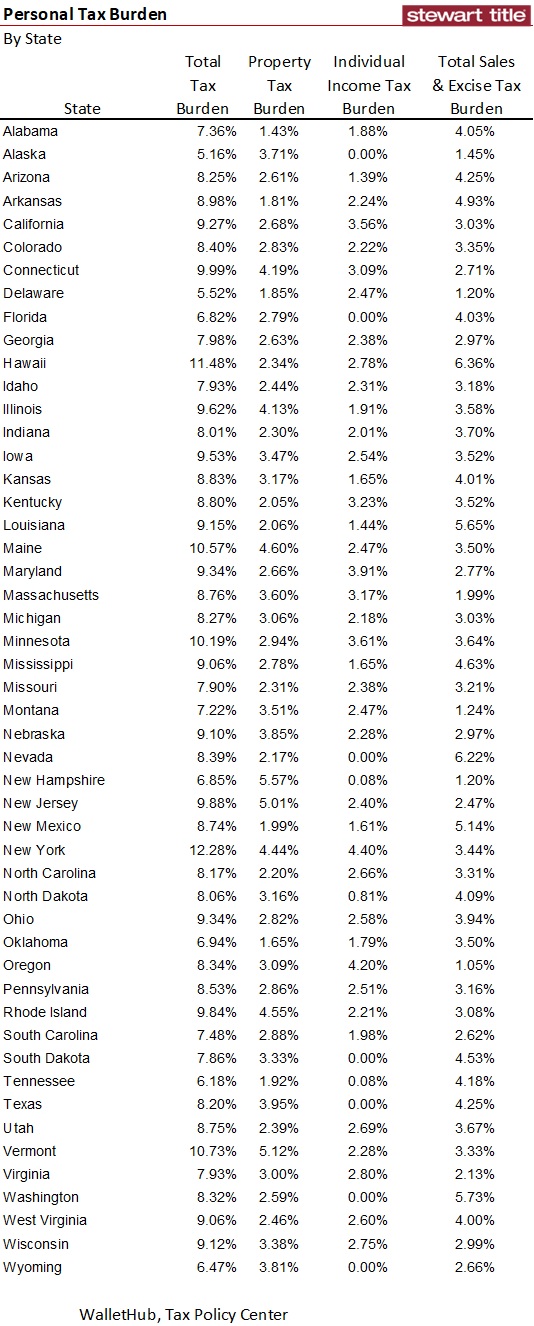

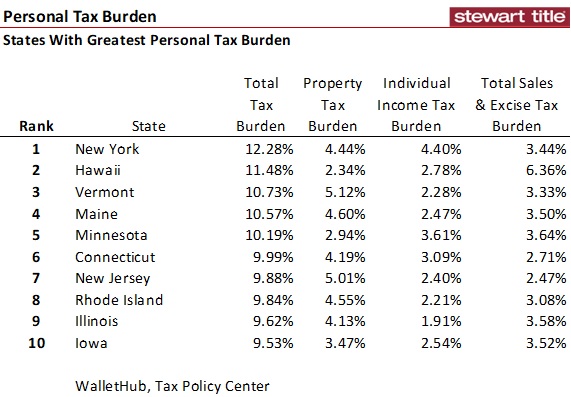

Another Top 10 List States With The Greatest And Least Personal Tax Burdens

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Another Top 10 List States With The Greatest And Least Personal Tax Burdens

Rhode Island Department Of Human Services Facebook

Cell Phone Tax Wireless Taxes Fees Tax Foundation

Cell Phone Tax Wireless Taxes Fees Tax Foundation

Another Top 10 List States With The Greatest And Least Personal Tax Burdens